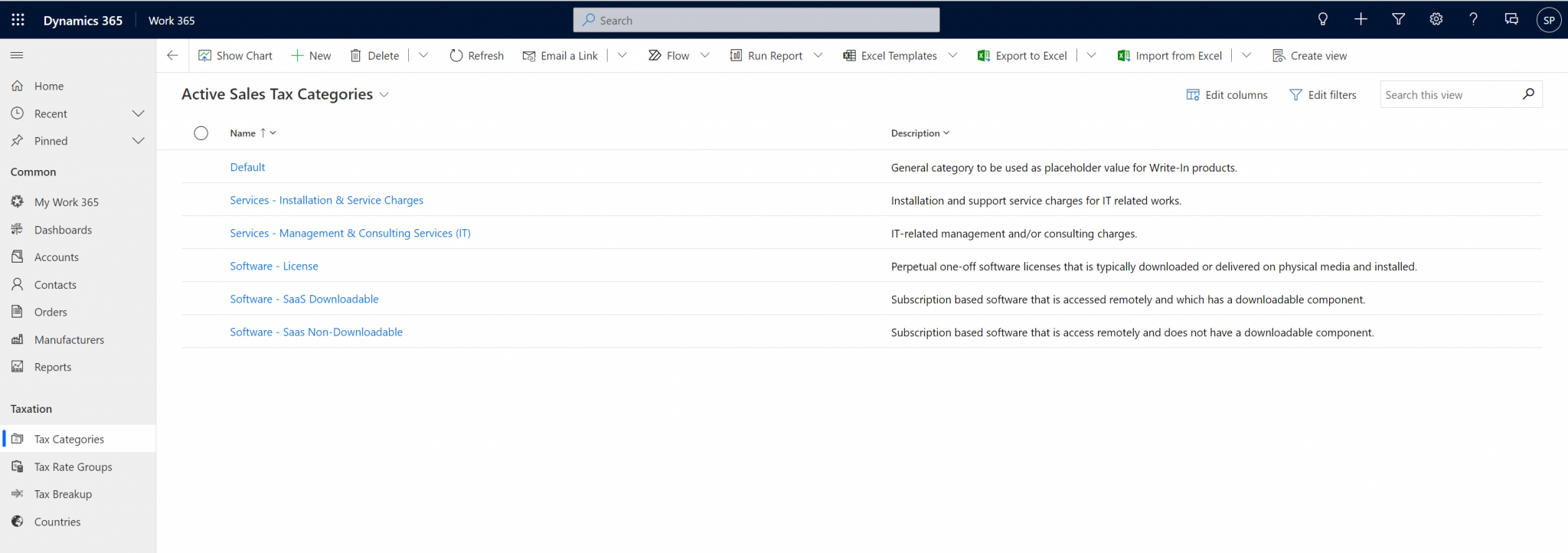

Work 365 Tax Categories

Tax categories are used for Tax Services when the Use Rates Directly setting on the Tax Service is No.

Tax categories are a way of classifying products into specific tax groupings.

It can be based on the region your business operates. They can be defined based on a specific tax rate and then associated with relevant products or services.

The tax category itself is literally just a group name for a set of products which belong to that group from a tax perspective (for example tax based on whether a software product is downloadable or not).

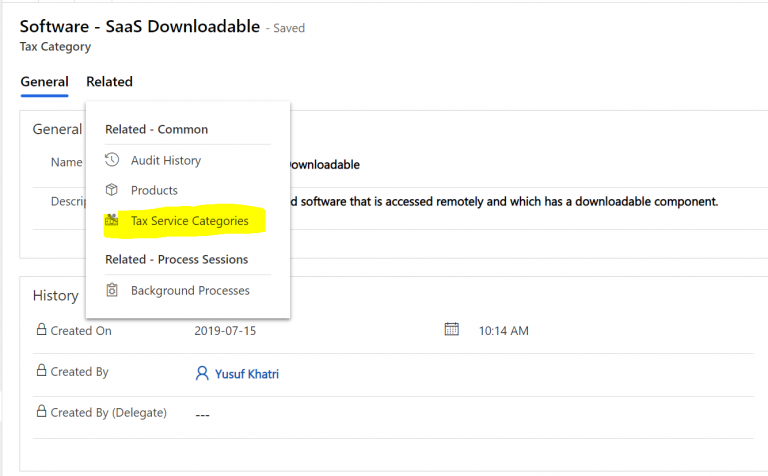

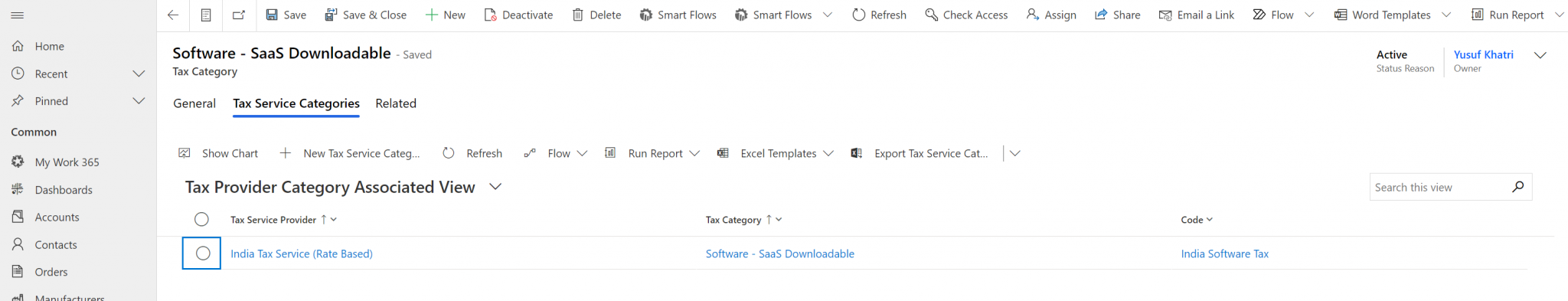

Once the applicable tax categories/groups are created, within each tax category click on related and select Tax Service Category.

Tax Service Categories

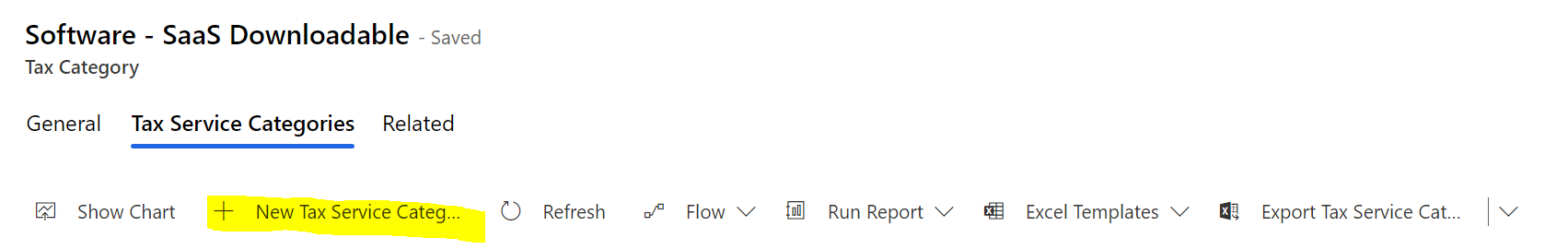

- On the Tax Category select +New Tax Service Category

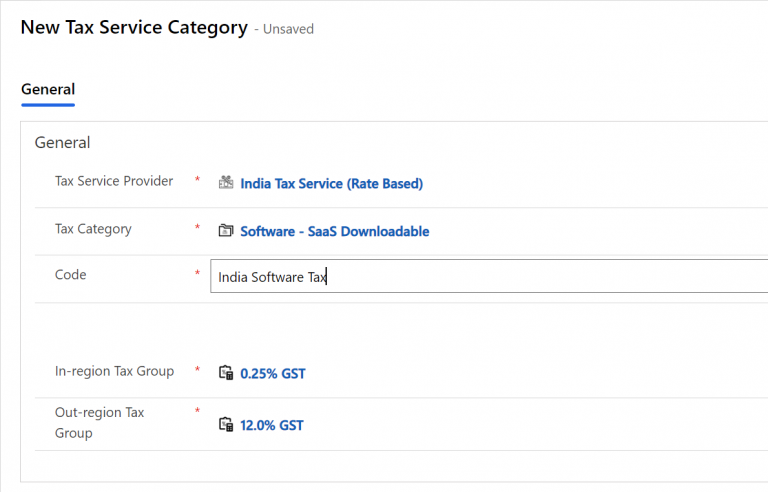

- Tax Service Provider: Add the Rate Based Tax Service which was created earlier where Use Rates Directly is No

- Tax Category: Select the Product Grouping for which the taxes will be applied

- Code: can be anything, but recommended to make the code in reference to the Tax Category

- In-region/Out-Region Tax Group: This means based on the customer’s address on the CRM account record, the system will apply the below tax rates for product items (subscriptions and/or non-recurring items) which are selected to be in the tax category/grouping from the previous field. In-region means the system is comparing the customer’s address against the Primary Address (HQ address) added to the Tax Service which is selected.

- If the customer’s address matches the state or country of the Primary Address on the tax service (based on the tax service setup), then the In-Region Tax group would apply on the product line item of the invoice.

- If the customer’s address does not match the state or country of the Primary Address on the tax service (based on the tax service setup), then the Out-Region Tax group would apply on the product line item of the invoice.

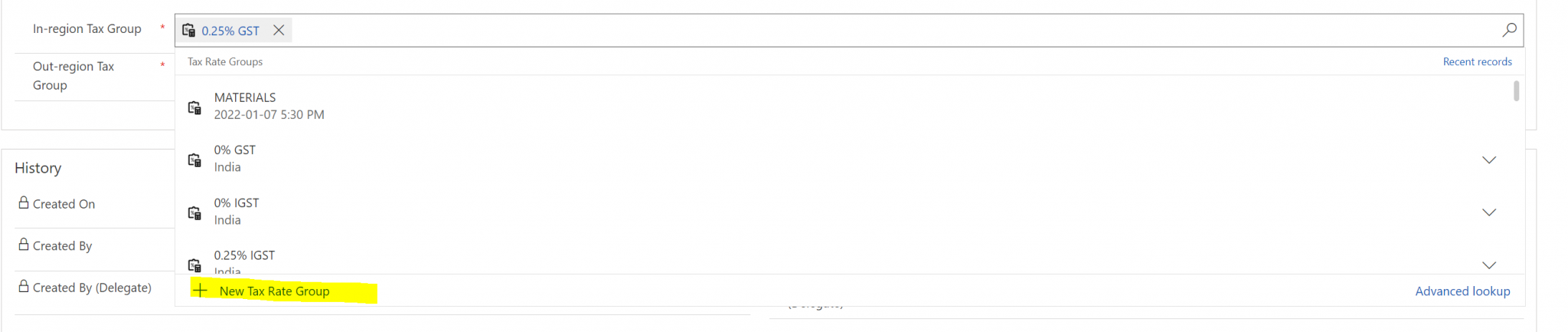

- To add the tax groups, click the search icon on the right and select +New Tax Rate Group

- Once the tax rate groups are added an In-region and Out-Region tax rate group.

- Click save&close once the fields are filled in

- The Tax Service Category has been added

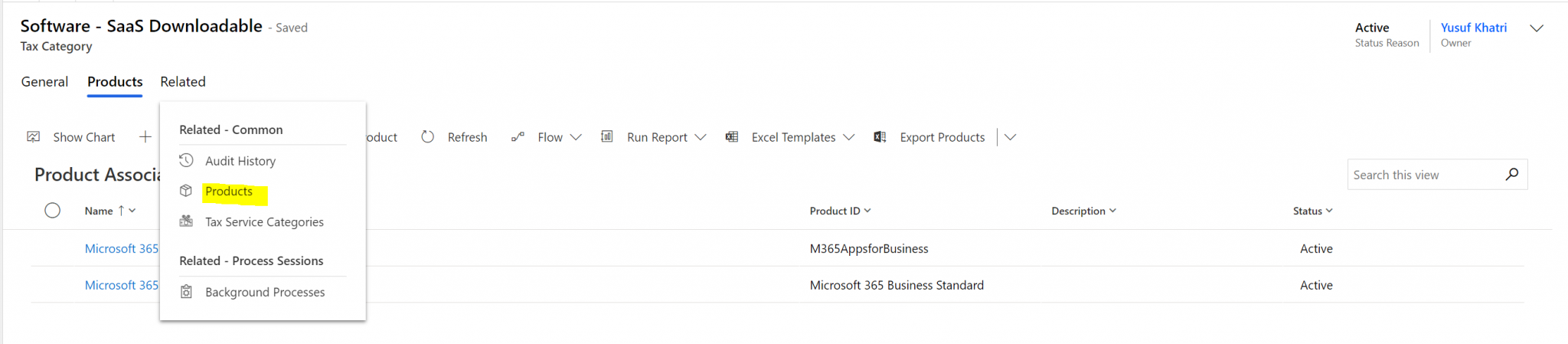

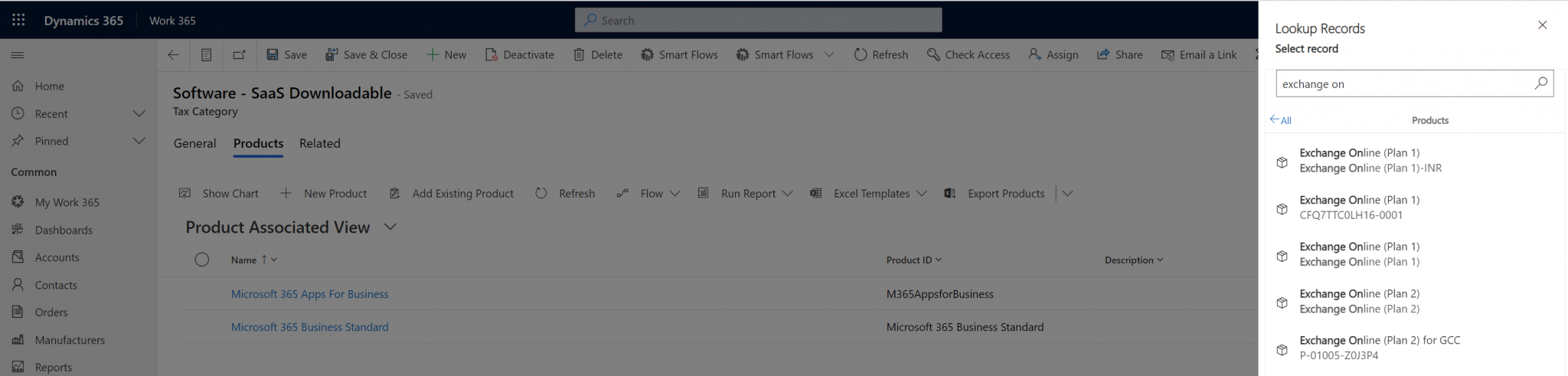

- Next click Related and select Products

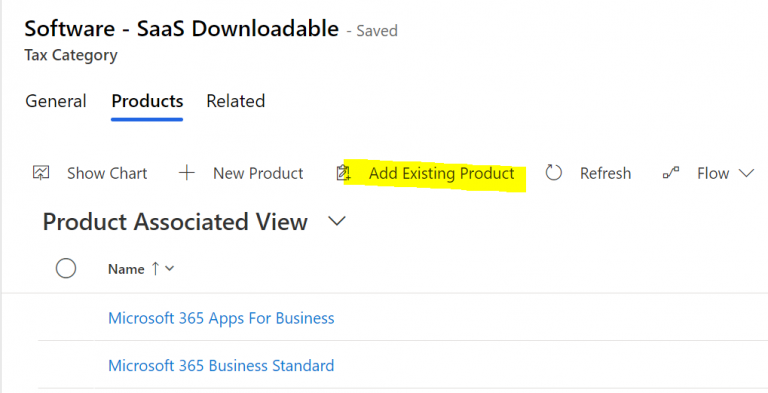

- Then click Add Existing Product to lookup products from the Dynamics product catalog which are eligible to be in the tax category/group which is currently open.

- Search and select applicable skus and click add.

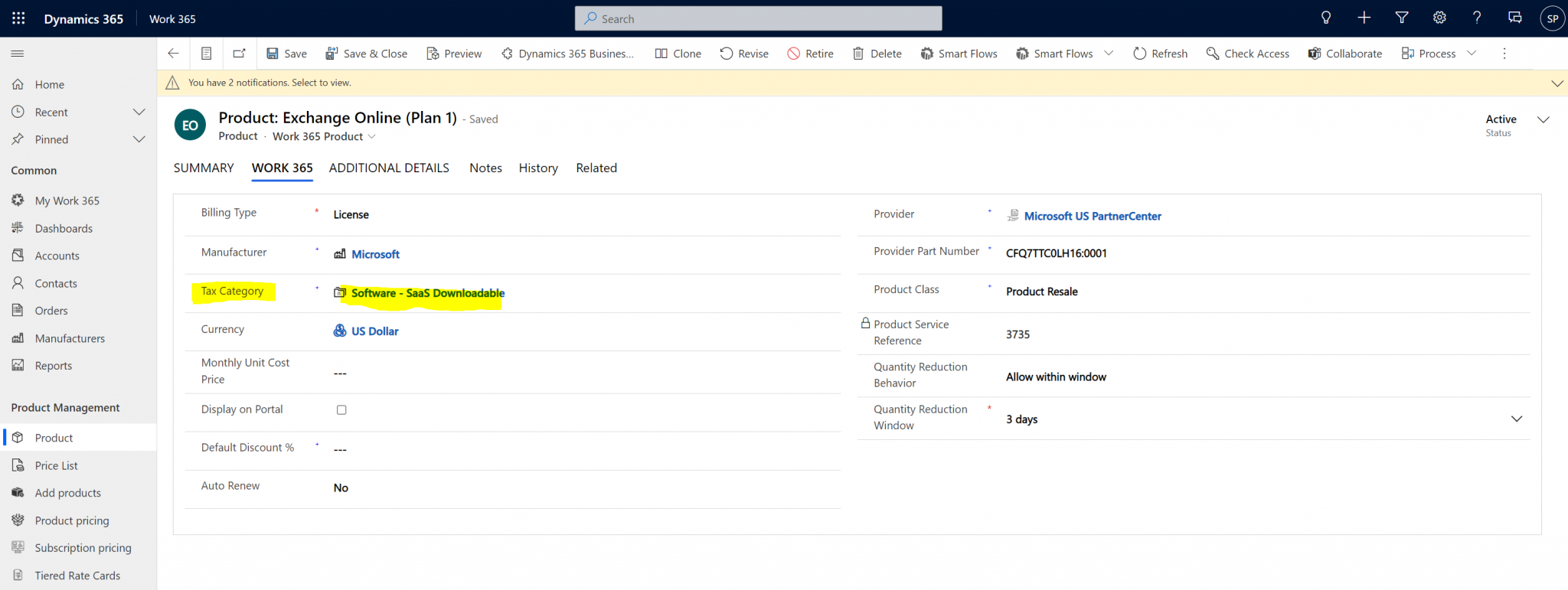

- Note: Tax Categories can also be specified directly on product records

- Follow the same steps as above to create a “Default” Tax Category for in the event where there are write in line items on the invoice, a default tax can be applied.

- Within this tax category

- Add a tax service category

- Select the same Tax Service

- Select the tax category for which the Default tax applies

- Add Default as the Code

- Set the In-region Tax Group and Out-Region Tax Group as the most likely used tax rates.

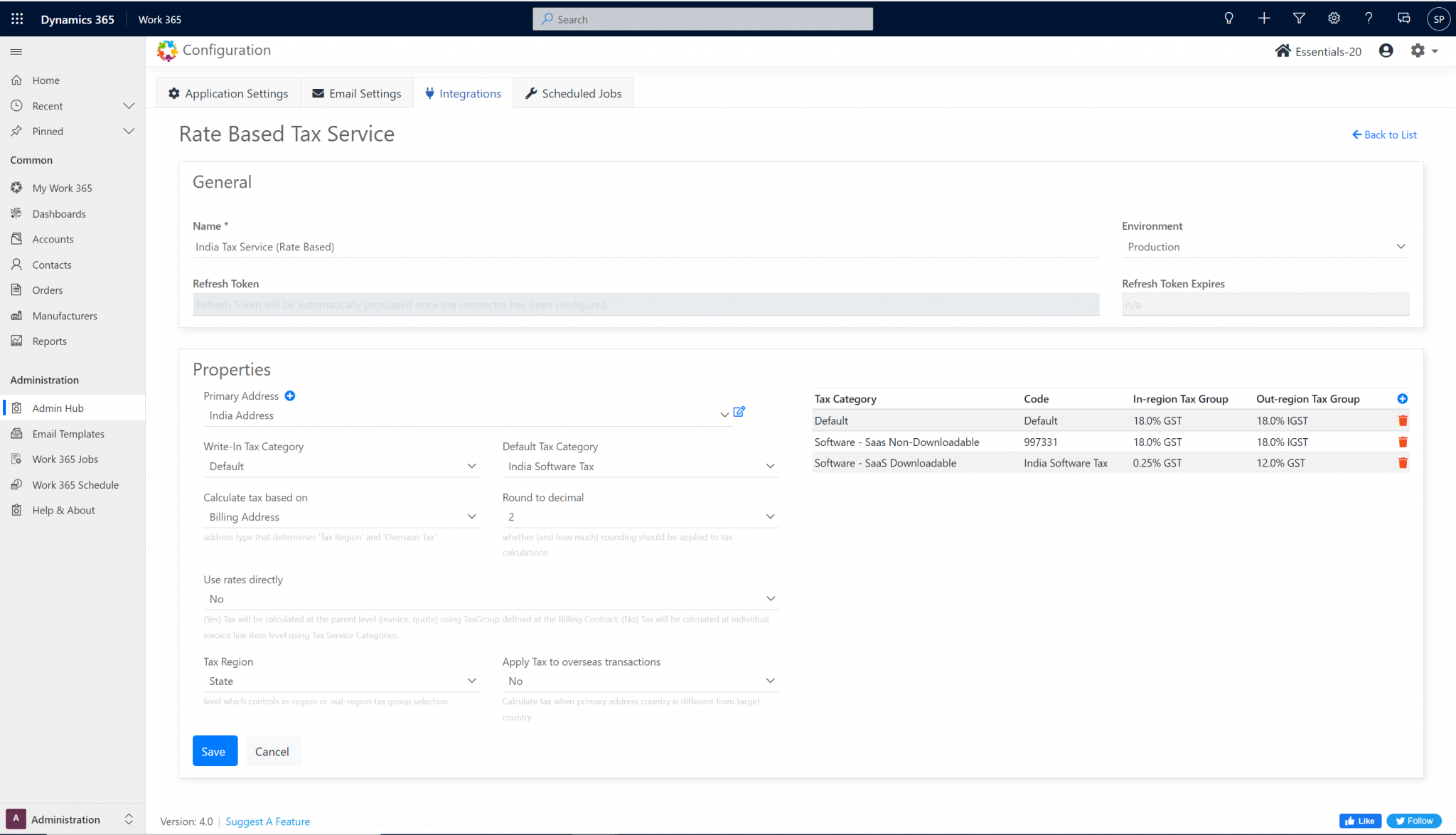

- Go back to the Rate Based Tax Service in the Admin Hub and add the Write-In and Default Tax Category

- Note all Tax Service Categories linked to the Tax Service will be shown on the right side.

Updated about 2 years ago